“The Cost of Delay in Investment Impactâ€

Introduction

In the world of investments, the adage “time is money†holds true. The cost of delay refers to the potential financial impact or opportunity cost incurred when an investment decision is postponed. Delaying investment choices can lead to missed opportunities, compound interest losses, inflation erosion, and other consequences that can significantly affect an investor’s financial journey. In this article, we will explore the implications of delaying investment decisions and the key points investors need to consider.

Missed Market Opportunities

One of the primary risks of delaying an investment decision is the missed opportunity to capitalize on potential market gains. The financial markets are dynamic and ever-changing, presenting various investment opportunities. When investors delay making investment choices, they may miss out on investing in assets or securities that could have provided higher returns or lower risks.

Compound Interest Losses

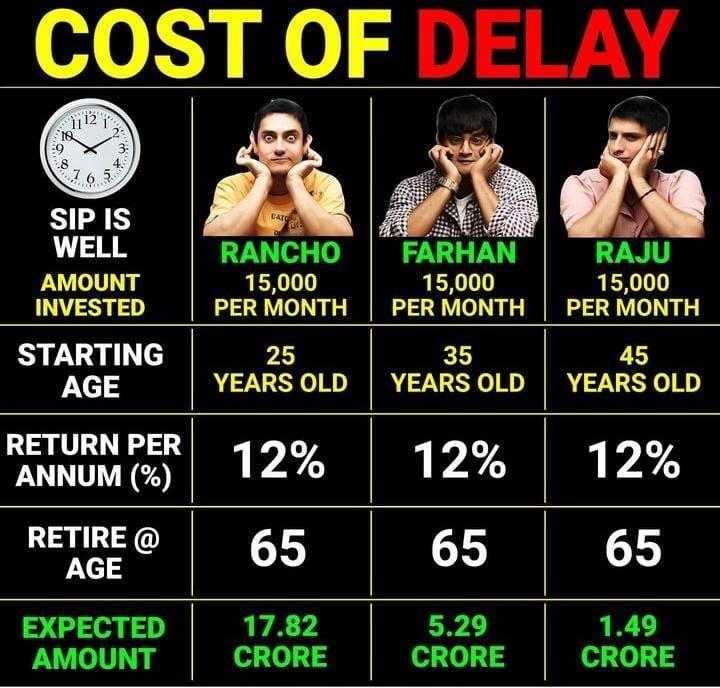

The power of compound interest can have a substantial impact on investment growth over time. Investors who start early benefit from the compounding effect, where returns generate additional returns. However, delaying an investment means missing out on the potential compounding of returns, reducing the overall growth of the investment portfolio.

Inflation Erosion

Inflation erodes the purchasing power of money over time. When investments are postponed, the real value of money decreases, and the returns generated from investments may not keep up with inflation. This can lead to a diminished ability to purchase goods and services in the future, effectively reducing the actual value of the investment.

Retirement Savings Impact

For individuals planning for retirement, delaying contributions to retirement savings can have a profound impact on their future financial security. The longer an individual delays saving for retirement, the more challenging it becomes to catch up and secure a comfortable retirement. Consistent and early contributions are crucial to building a sizable retirement fund.

Time in the Market

The adage “time in the market beats timing the market†holds true in the investment world. Staying invested in the market for an extended period allows for potential growth and recovery from market downturns. Delaying entry into the market may limit the benefits of being invested over the long term, potentially missing out on significant growth opportunities.

Missed Diversification Opportunities

Diversification is a fundamental strategy to manage risk in an investment portfolio. Delaying investment decisions may prevent investors from effectively diversifying their portfolio, leading to increased risk exposure. A well-diversified portfolio spreads risk across different asset classes, reducing the impact of adverse events on the overall investment.

Opportunity Cost

The cost of delay can also be viewed as an opportunity cost. By delaying an investment, an investor forgoes the chance to allocate funds to more profitable or promising investments. This lost opportunity can hinder wealth accumulation and may lead to regrets in the future.

Balancing Careful Consideration and Timely Action

While thorough research and analysis are essential before committing funds, excessive delay can have negative consequences. Investment decisions should not be rushed, but it is crucial to strike a balance between careful consideration and taking timely action. Timing plays a critical role in the world of investing, and understanding the cost of delay is key to making informed and successful investment decisions.

Conclusion

The cost of delay in investment impact can be substantial. Investors must recognize the risks associated with postponing investment decisions. Missed market opportunities, compound interest losses, inflation erosion, retirement savings impact, time in the market, missed diversification opportunities, and opportunity cost are all factors that can influence an investor’s financial journey. Striking a balance between thorough consideration and timely action is essential to maximize investment returns and achieve financial goals.

FAQs

1. Is it always a bad idea to delay investments? While it’s essential to consider investment decisions carefully, delaying investments indefinitely can lead to missed opportunities and potential financial setbacks. Balancing thoughtful consideration with timely action is crucial.

2. How can I mitigate the cost of delay? Stay informed about market trends, work with a financial advisor, and consistently contribute to your investment portfolio to reduce the impact of delay.

3. Can I recover from delayed investment decisions? While recovery is possible, it becomes increasingly challenging the longer you delay. Starting early and staying committed to your investment goals are key to achieving success.

4. Should I prioritize certain investments over others? Prioritizing investments depends on your financial goals, risk tolerance, and time horizon. Diversification is vital, but strategic allocation is equally important.

5. Is there a “perfect†time to invest? The investment markets are unpredictable, making it challenging to time the “perfect†entry. Instead, focus on a long-term investment strategy and stay disciplined in your approach.

For example, let’s say you want to invest in a mutual fund that has a CAGR of 10%. You want to retire with a corpus of Rs. 10 lakhs. If you start investing today, you will need to invest Rs. 25,000 per month for the next 30 years. However, if you delay your investment by 5 years, you will need to invest Rs. 35,000 per month for the next 25 years. The cost of delayed investment in this case is Rs. 10,000 per month.

- The cost of delayed investment can be significant, so it is important to start investing as early as possible. Even a small delay can have a big impact on your long-term financial goals.