Directors and Officers (D&O) Insurance-Understanding D&O Insurance: Protect Your Business

Understanding D&O Insurance: Protect Your Business Like a Pro

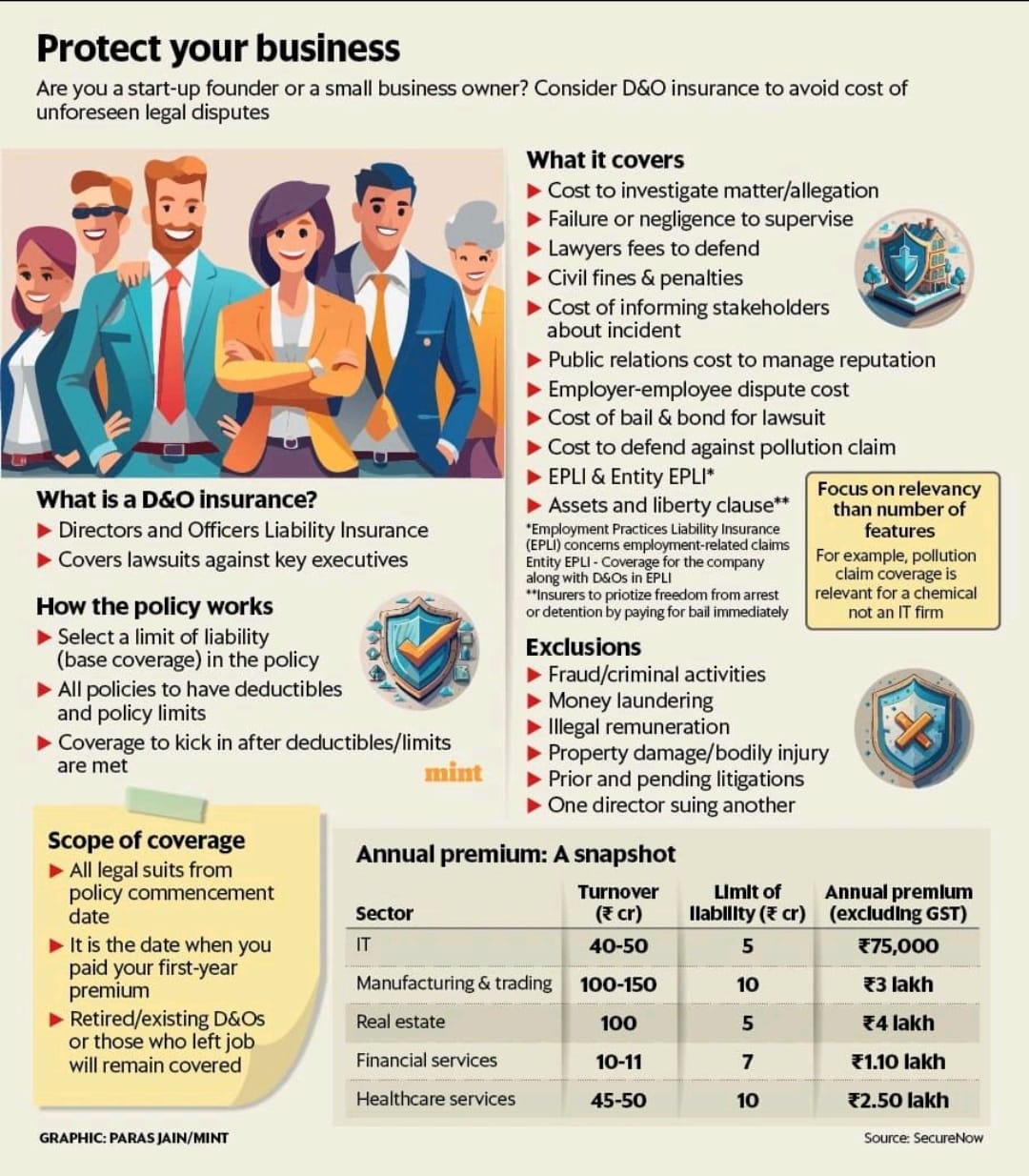

Are you a startup founder or a small business owner? Running a business is exciting, but it comes with risks—especially legal ones. That’s where Directors and Officers (D&O) Insurance steps in to save the day! Let’s break it down in a simple way.

What is D&O Insurance?

D&O Insurance is like a safety net for the key people running your business—your directors and officers. It covers lawsuits against them, protecting their personal assets from unexpected legal battles.

How Does It Work?

- Choose Your Coverage: Pick a limit (base coverage) that fits your needs.

- Deductibles Apply: You pay a small amount first, and the policy kicks in after that.

- Stay Protected: All policies have limits, but they cover legal costs once deductibles are met.

What Does It Cover?

Imagine this: a client sues you, or an employee files a dispute. D&O insurance has your back with:

- Costs to investigate and defend allegations

- Lawyer fees to fight your case

- Civil fines and penalties

- Expenses for informing stakeholders

- Public relations costs to manage your reputation

- Employer-employee dispute costs

- Bail bond costs if needed

- Plus, it includes EPLI (Employment Practices Liability Insurance) for workplace issues

Note: Coverage focuses on relevance—pollution claims or chemical damage might not be included unless specified.

What’s Not Covered?

Some things are off-limits, like:

- Fraud or criminal activities

- Money laundering

- Property damage or bodily injury

- Prior or pending litigations

- One director suing another

Scope of Coverage

- All Legal Suits: Covered from the policy’s start date.

- First-Year Premium: It’s when you pay your initial amount.

- Retired/Existing D&Os: Even if they’ve left, they remain protected.

Annual Premium Snapshot

Here’s a quick look at costs (excluding GST) based on your sector:

- IT: ?40,000–50,000 (Limit: 5 cr)

- Manufacturing & Trading: ?3 lakh (Limit: 10 cr)

- Real Estate: ?4 lakh (Limit: 5 cr)

- Financial Services: ?1.10 lakh (Limit: 7 cr)

- Healthcare Services: ?2.50 lakh (Limit: 10 cr)

Why Get D&O Insurance?

Running a business means making tough calls. D&O insurance gives you peace of mind, ensuring you’re not personally on the hook for legal costs. Whether it’s a startup or a growing company, it’s a smart move to protect your future.

Ready to safeguard your business? Talk to an insurance expert today!

Source: SecureNow