Beginner’s Guide to Mutual Funds in India – Start Smart, Grow Your Money

Beginner’s Guide to Mutual Funds in India – Start Smart, Grow Your Money

Thinking about investing your money but not sure where to begin?

Mutual funds are a good starting point for many people in India.

They are simple to understand, easy to start, and suitable for long-term goals like buying a home, planning retirement, or saving for your child’s education.

Mutual funds invest your money in a mix of shares, bonds, and other instruments.

These investments are managed by professionals, so you do not have to track markets every day.

Over time, mutual funds help your money grow with less stress than buying individual stocks on your own.

1. What Are Mutual Funds?

A mutual fund collects money from many investors.

This pooled money is then invested in different assets such as:

The key benefit is diversification.

Instead of putting all your money into one company, your investment is spread across many.

This reduces risk and improves stability over the long term.

Mutual funds are suitable for beginners as well as experienced investors.

2. How Many Mutual Funds Should You Buy?

There is no fixed rule, but most experts suggest 5 to 7 mutual funds are enough.

Why not more?

A balanced mix usually includes:

Fewer, well-chosen funds make investing simple and manageable.

3. Should You Invest Monthly or All at Once?

There are two common ways to invest:

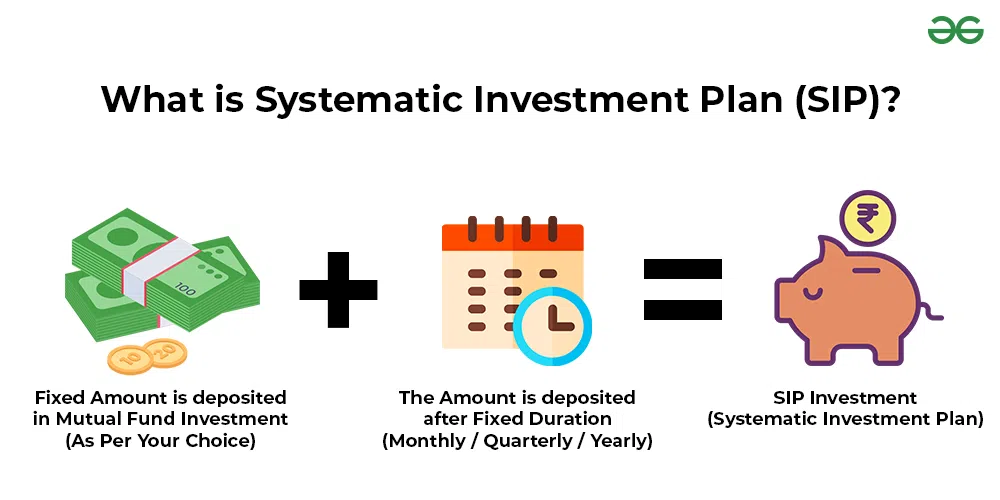

Monthly SIP (Systematic Investment Plan)

You invest a fixed amount every month.

Lump Sum Investment

You invest a large amount at one time.

For most beginners, SIP is safer and easier to manage.

4. Can Mutual Funds Help You Save Tax?

Yes.

ELSS (Equity Linked Savings Scheme) funds offer tax benefits under Section 80C.

Key points:

ELSS is suitable for long-term investors who want tax savings along with growth.

5. Can You Invest Together With Someone?

Yes.

Mutual funds allow joint holding with up to three people.

This is useful when investing with:

Joint holding helps in smooth ownership transfer and better financial planning.

6. Planning Multiple Goals?

Mutual funds allow you to invest for many goals at the same time, such as:

For each goal, decide:

Choose funds based on each goal, not one fund for everything.

7. Importance of Goals and Planning

Before investing, ask yourself:

Clear goals help you stay calm during market volatility.

Good planning prevents panic selling and improves long-term returns.

8. A Simple Path to Begin

Follow these simple steps to start:

Final Thought

Mutual funds are not quick-money schemes.

They are meant for long-term wealth creation.

With proper planning, regular investing, and patience, mutual funds can help you grow your money steadily and reach your financial goals with confidence.

Review once a year

Avoid frequent changes.

Start SIPs

Small monthly investments build discipline.

Choose the right funds

Equity for growth, debt for stability, hybrid for balance.

Check your risk appetite

Conservative, moderate, or aggressive.

Set clear financial goals

Home, retirement, education, or travel.

Can I handle market ups and downs?

When will I need this money?

Why am I investing?

Monthly investment amount

Risk you can take

Time available

Retirement

Children’s education

Foreign travel

Buying a car

Family members

Spouse

Invest mainly in equity

Lock-in period of 3 years

Tax deduction up to ?1.5 lakh per year

Works better when markets are stable

Suitable when you have surplus money

Reduces market timing risk

Builds discipline

Ideal for salaried investors

Hybrid funds for balance

Debt funds for stability

Equity funds for growth

Overlap reduces efficiency

Many funds may invest in the same companies

Too many funds are difficult to track

A mix of both

Debt (bonds and fixed-income instruments)

Equity (company shares)